Top online payment methods compared

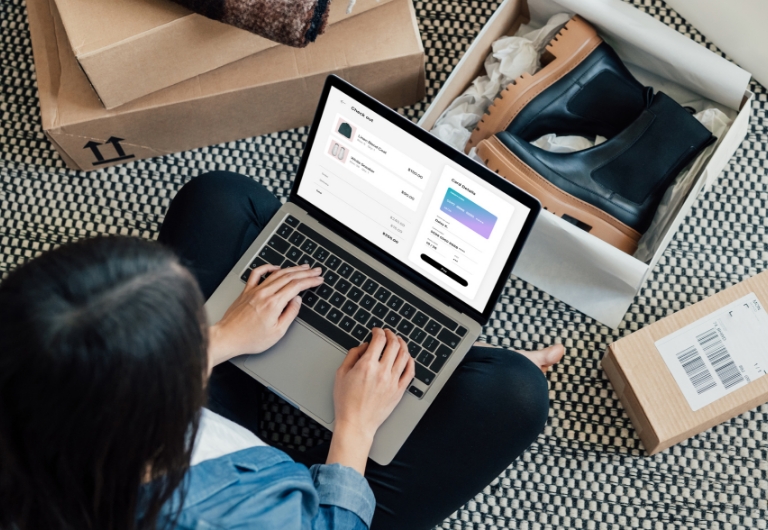

Shoppers have embraced online shopping more than ever in recent years, drawn by its speed and convenience. Major shopping events like Amazon Prime Day, from 8-11 July 2025, add fun and excitement to the experience. At the same time, the range of payment options for goods and services online has expanded. With so many different online payment methods available, each offering unique features and benefits, it can be tricky to figure out which one is best for you. To help you navigate the many alternatives, we’ve compared some of the top online payment methods, including PayPal, e-gift cards, Klarna, Clearpay and mobile payments, to help you make better choices.

What to look for in an online payment method

Before going into the comparisons, here are some key factors to consider when selecting a payment method.

- Ease of use: Is the platform user-friendly for both senders and recipients?

- Security: Does it provide encryption, fraud protection and data privacy?

- Cost: Are the transaction fees reasonable? Are there any hidden charges?

- Global reach: Can you use it for international purchases?

- Flexibility: Does it offer various ways to pay or earn rewards?

Comparison of popular online payment methods

PayPal

PayPal is one of the most trusted and widely used payment platforms worldwide. It allows users to send and receive money, make purchases and even earn rewards. And if you sign up with LifePoints, you can earn PayPal gift cards that you can use when shopping online.

Key features:

- Global availability across multiple currencies

- Integration with e-commerce platforms and apps

- Secure transactions with buyer protection

Pros:

- Easy to use and widely accepted

- Secure and reliable for international transactions

Cons:

- Higher fees for some transactions, especially for merchants

E-gift cards

E-gift cards are versatile and convenient – perfect for gifting or budgeting. When you join a community like LifePoints, you can earn e-gift cards from leading brands, including Amazon, M&S and more, helping you save on everyday purchases.

Key features:

- Accepted at a wide range of retailers

- No need for physical cards or shipping

- Flexible use across various categories

Pros:

- No fees involved

- Ideal for both personal use and gifting

Cons:

- Limited to participating retailers

Klarna

Klarna offers a flexible “buy now, pay later” feature, making it a popular choice for shoppers who want to spread payments over time.

Key features:

- Decide which purchases you want to keep and only pay for what you want up to 30 days later

- Or pay in 4 interest-free instalments every 2 weeks

- Wide acceptance among online retailers

- User-friendly app for managing payments

Pros:

- Great for budgeting and managing expenses

- No interest on instalments if paid on time

Cons:

- Late payment fees can add up quickly

- Limited availability outside partnered retailers

Clearpay

Clearpay, another “buy now, pay later” platform, offers similar services to Klarna but with its own unique features.

Key features:

- Pay in four interest-free instalments over six weeks

- Quick and easy setup

Pros:

- Ideal for smaller purchases

- Straightforward repayment terms

Cons:

- Late fees apply if payment deadlines are missed

- Limited to certain regions and retailers

Google Pay and Apple Pay

Mobile payment systems like Google Pay and Apple Pay are perfect for quick and secure payments through smartphones and smartwatches.

Key features:

- Seamless integration with mobile devices

- Contactless payment at participating stores

Pros:

- Fast and secure

- Convenient for everyday use

Cons:

- Limited to specific ecosystems (Android for Google Pay, iOS for Apple Pay)

Which payment method is best for you?

If budgeting and flexibility are priorities for you, Klarna and Clearpay are excellent solutions for managing expenses over time. For gifting and rewards, PayPal and e-gift cards are secure and easy options. With LifePoints, you can earn both as rewards! In terms of everyday convenience, it’s hard to beat Google Pay and Apple Pay with their contactless, on-the-go payments. Ultimately, the best payment method for you will depend on your shopping habits, security concerns and your preferred mobile device.

Emerging trends in online payments

“Buy now, pay later” is a sought-after feature offered by payment systems like Klarna and Clearpay. As with any sort of instalment plan, you need to keep track of your payment deadlines in order to avoid fees or interest charges. E-gift cards are also gaining popularity. Their versatility and ease of use make them a great way to share with others or save money on your own everyday purchases. Finally, more and more people are discovering user-friendly platforms like LifePoints, where members can earn points for their opinions and exchange them for PayPal or e-gift cards.

Flexibility, security and global reach: Online payment methods offer many unique advantages to help you with your purchases over the Internet. Ready to explore the benefits of online payments? Join LifePoints for a great way to earn rewards like PayPal and e-gift cards, and start making your opinions count now.